- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Oil, Metals, Soft Commodities

- Will commodity prices continue to slide?

- Home

- News & Analysis

- Articles

- Oil, Metals, Soft Commodities

- Will commodity prices continue to slide?

- Production Levels: Variations in production due to technological advancements, increasing or decreasing cost of extraction, industrial action, or natural disasters can significantly impact supply. For instance, a major oil producer increasing output can lead to a surplus, driving prices down.

- Geopolitical Events: Conflicts, trade embargoes, or political instability in key producing regions can disrupt supply chains. The 2022 Russia-Ukraine conflict, for example, led to disruptions in wheat and energy supplies, causing price spikes.

- Economic Growth: Clearly economic growth has a positive impact of demand for commodities as multiple projects are more likely to have funding available both on a micro level with individual businesses and a macro level with national funding potentially more available. Conversely, economic slowdowns reduce demand, leading to price declines.

- Organisational Activity: Sectors such as construction and manufacturing drive demand for raw materials. A surge in infrastructure projects can elevate demand for commodities like cement and iron ore. Additionally, of course where increases and cuts in production are controlled by organisations where these exist, OPEC being the obvious example, then this will alter the supply-demand relationship, and so price.

- Consumer Behaviour: Actual or potential shifts in consumer preferences, either originating from the consumer (or government poli, such as increased demand for electric vehicles, boost the need for lithium and cobalt. Alternatively, a move towards plant-based diets can affect meat commodity markets.

- GDP Growth: Strong GDP growth signals robust economic health, increasing demand for commodities. In contrast, recessions typically lead to reduced demand and lower prices.

- Inflation: High inflation can erode purchasing power, decreasing demand. However, commodities like gold often serve as inflation hedges, potentially increasing their demand and price.

- Interest Rates: Higher interest rates can strengthen a currency, making commodities priced in that currency more expensive for foreign buyers, potentially reducing demand.

- U.S. Dollar Relationship: Many commodities are priced in U.S. dollars. A stronger dollar makes commodities more expensive for holders of other currencies, potentially reducing global demand and lowering prices. Conversely, a weaker dollar can make commodities cheaper internationally, boosting demand and prices.

- Wars and Conflicts: Armed conflicts can disrupt production and supply chains, leading to shortages and price increases. The Middle East conflicts have historically affected oil prices due to supply concerns.

- Sanctions: Economic sanctions on producing countries can limit supply. For example, sanctions on Iran have impacted global oil supply and prices.

- Trade Agreements: New trade deals can open markets, increasing demand and prices, while trade disputes can lead to tariffs, reducing demand and affecting prices.

- Government policy: Specific changes in government policy, often occurring significantly on change in government as well as midterm will impact of perceived future demand

- Support and resistance levels: Previous price action turning points are points at which there has already been significant price action previously, these are used as reference for change in sentiment are places at which future decisions may be made and where many traders place pending orders

- Market psychological levels: “Round numbers” are often seen, even if largely illogical in terms of actual value of an asset, as being important to market psychology. Multiple of $10, $100, $1000 for example may prove stubborn to breach or significant if there is a move through, often precipitating further trading activity.

- Utilization Changes: Developments in renewable energy technologies can reduce demand for fossil fuels, impacting their prices.

- Potential for Recovery:

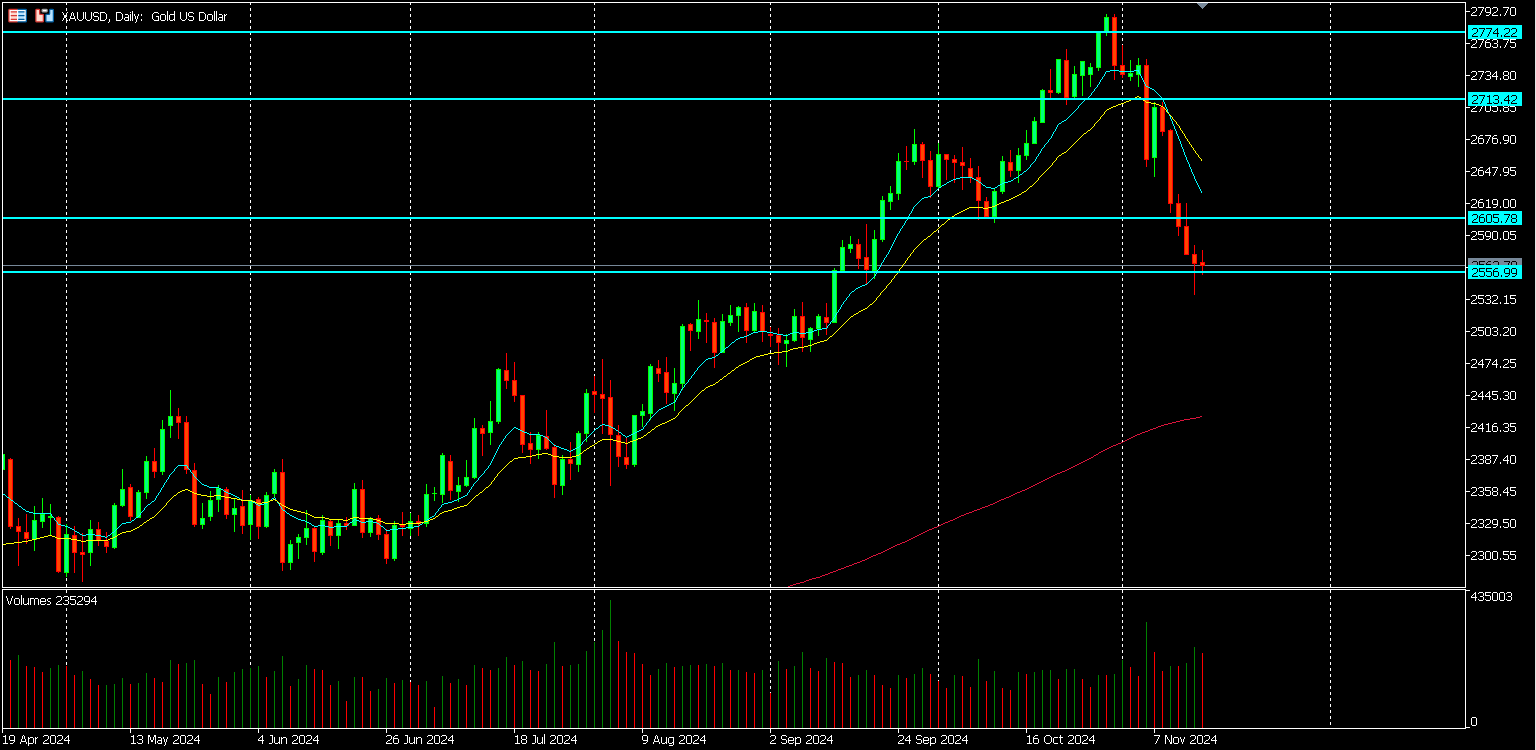

- Some strategists believe that ongoing geopolitical uncertainties and central banks’ gold purchases could support a rebound in gold prices.

- Continued Downward Pressure:

- Conversely, if the U.S. dollar remains strong and interest rates stay elevated, gold may face further declines.

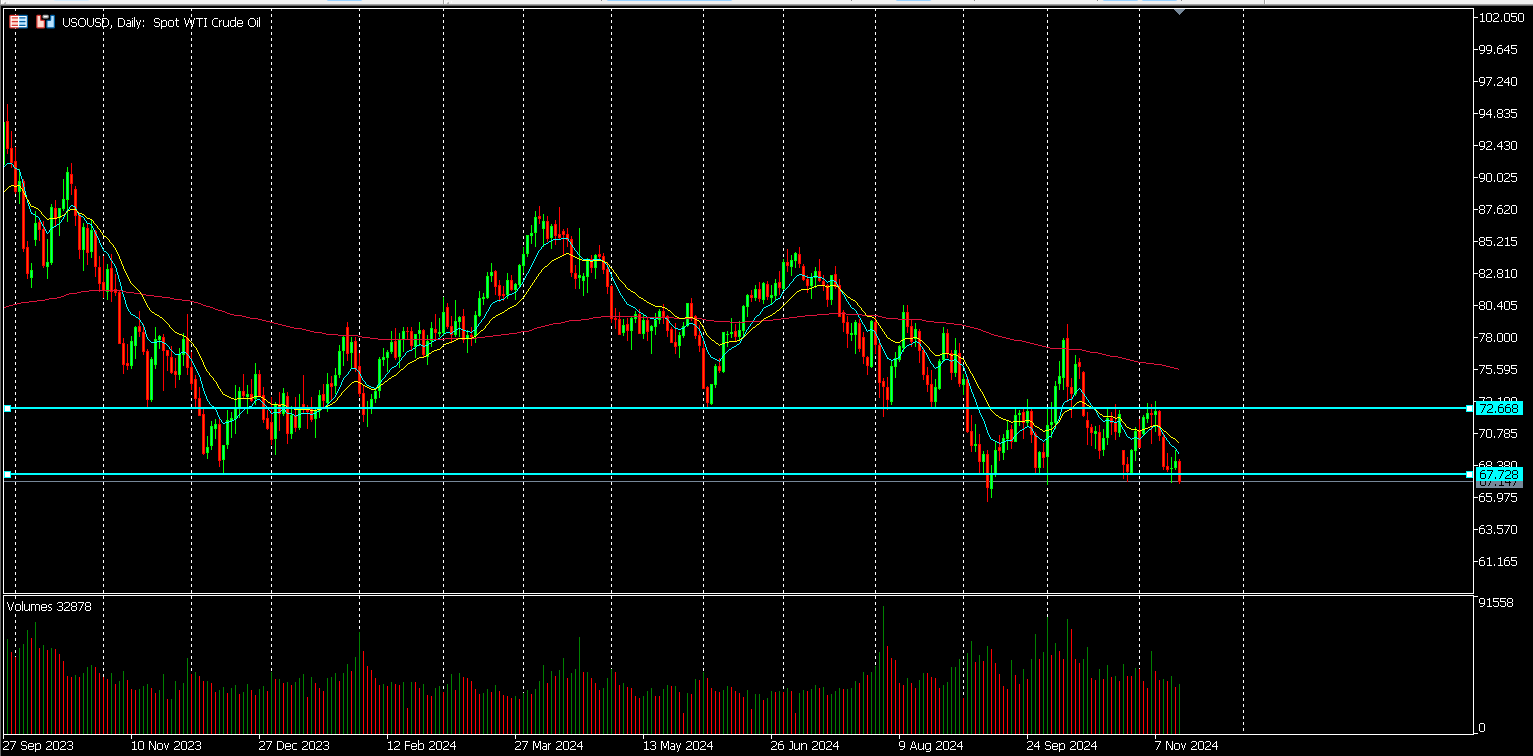

- China, the world’s largest crude importer, has shown signs of a sluggish economic recovery, leading to reduced oil consumption. In October, China’s oil processing dropped by 4.6% year-over-year, marking the seventh consecutive month of decline.

- The International Energy Agency (IEA) forecasts an oversupply of oil by 2025, anticipating a supply surplus of 1 million barrels. This expectation has contributed to downward pressure on current oil prices.

- A strengthening U.S. dollar, which reached its highest in a year, has made oil more expensive for holders of other currencies, thereby reducing global demand and contributing to price declines.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe last two months, with accelerated selling over the last fortnight, have seen considerable drops in major commodity prices.

Oil is at its lowest point since early September, copper likewise and gold futures have dropped almost 8% since the beginning of the month after making record highs.

Consequently, on the ASX we have seen the materials sector as a whole drop 6.92%.

Whether a trader or investor in commodity futures or companies in that sector the impact has been significant.

In this overview article we discuss the reasons for this and offer some thinking on what may be next for price movement in the three major commodity assets of gold, copper and oil.

We will first review factors which influence price before subsequently using these concepts to help understanding of what may be happening,

What moves commodity prices – an overview?

In any examination of commodity pricing, it is worth revisiting the broad drivers of market sentiment towards commodities as it will provide context not only for what is happening now but going forward in the short and long term.

Although there will be fluctuations due to repositioning from market participants, including of course institutional holding and even government stock levels, we would suggest that there are five key factors:

1. Supply and Demand Dynamics:

a. Factors Affecting Supply:

b. Trends in Demand:

2. Global Economic Conditions:

3. Currency Fluctuations:

4. Geopolitical and Government Events:

5. Technical price movements

Whichever way you slice it, the impact of actual price movements both current and historical does contribute to what may happen to price subsequently, at least in the short term.

There are two key references that are worthwhile bearing in mind.

So, what has happened to pricing and what next?

As previously stated, we will focus on the three main commodities of gold, oil and copper and using the broad principles above attempt to unpick what has happening and look into the market “crystal ball to provide a potential outlook.

Gold

Gold price breach of a key resistance level after six months of rangebound trading in July signified a major shift in sentiment for the precious metal, and markets saw the interesting and somewhat unusual state where Gold and the USD were moving in the same direction.

Gold hit record highs, reaching almost 2800 on 30th October. An expected profit-taking retracement at the turn of the month soon turned into a reversal, as USD strength continued, and the price dropped through 2700 then 2600 before coming to rest and pause at a 2-month low and what could turn into a support level at 2550 on Friday.

Further selling could see price challenge the next key psychological level at 2500

The recent Gold price decline has been influenced by three key factors:

1. Strengthening U.S. Dollar:

The U.S. dollar has appreciated due to robust economic data and perhaps a pause in rate cuts the Federal Reserve and the inflationary pressures of tariffs if implemented by the incoming new US administration in January. A stronger dollar makes gold more expensive for holders of other currencies, reducing its demand and price.

2. Rising Bond Yields:

Increased U.S. Treasury yields have made interest-bearing assets more attractive compared to non-yielding assets like gold, leading investors to shift away from gold.

3. Reduced Geopolitical Tensions:

Although the potential for re-escalation of geopolitical tensions is always present, particularly in the Middle East, appear for now to be decreasing when compared to that of a couple of months ago. Increasing geopolitical tension often results in a flight to safety. There is no doubt this contributed to the previous gold price strength and hence a decrease in tension has resulted in a decrease in price.

Outlook:

Analysts have mixed views on gold’s future trajectory:

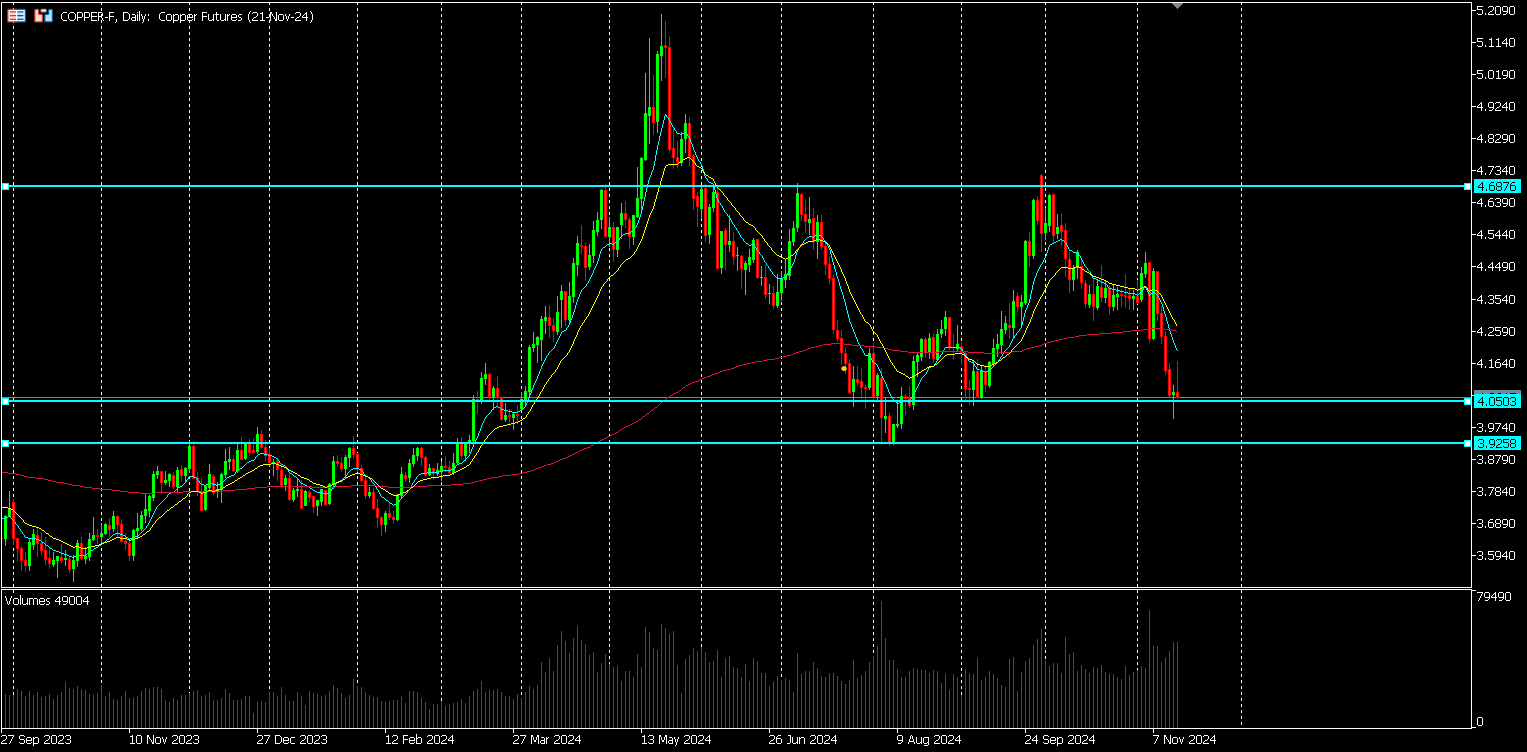

Copper

Copper futures hit record highs in May this year of $5.20 and gave away over 25% to not a low in mid-august of $3.19 to officially enter bear market territory. It has been a wild ride since then with a strong but temporary rally upwards followed by a sharp sell-off over the last couple of weeks, with a price move through the 200ema and pausing at support around $4.05.

A breach of $4 and August’s low price could precipitate more selling.

Downwards pressure on copper prices is occurring due to three key factors:

1. Weakening Demand from China:

China, the world’s largest consumer of copper, has experienced economic challenges, particularly in the real estate sector. Impacts of an increases in US tariffs may slowdown exports and further upset growth. An actual and potentially worsening reduced demand for copper may contribute further to price declines.

2. Global Economic Uncertainties:

Concerns about a global economic slowdown have, and may continue to, dampen industrial activity including construction, decreasing the demand for copper globally. Although, it is fair to categorise the slowdown to be a “soft landing” after potential widespread recession was potentially on the agenda.

3. Supply Surplus:

Increased production and rising global inventories have led to a surplus in the copper market, exerting downward pressure on prices. The demands of copper usage from renewable energy infrastructure projects were one of the reasons why we saw bullish moves in copper through the early part of the year. But with stock level as increased and perhaps a “handbrake’ on the enthusiasm frow governments funding of infrastructure, and notably clear pre-election narrative from the Republicans in the US perhaps the market in pricing a decrease in such compared to that which was expected.

Copper Outlook:

Generally, analysts appear unoptimistic relating to copper’s future trajectory, although as you would expect there are still some contrary views.

Continued Downward Pressure looks likely in the short term with most analysts suggesting at best a maintenance of current range around the $4 level. Of course, USD strength is contributory to potential demand challenges in those transaction in alterative currencies. Many are seeing a test of August lows as likely.

In the longer term, demand may still be intact driven by the global energy decarbonisation and related infrastructure projects, could support a rebound in copper prices. However, the latter may take some time to see moves that push price anywhere near May levels which now seem an increasingly distant memory.

Oil

Friday’s close price on the WTI futures contract fell slightly below lows last hit the end of October and September respectively at $67.14, and recording a 7% drop for the week.

Any further drop is likely to threaten mid-September lows, and a breach of this would represent a low price not seen for 18 months.

Although this could be seen as positive from a reduction in inflation point of view, at this stage the pressure is most certainly downwards.

Oil prices have recently declined due to several key factors:

1. Weaker Demand from China:

2. Supply Surplus Expectations:

3. Stronger U.S. Dollar:

Outlook:

Although there are mixed views on the future trajectory of oil prices, Chinas economic state is critical. This could further impact on a supply surplus, as would the proposed ramp up of US oil production as outlined in Trumps “drill, baby, drill” pre-election promises.

OPEC+ production decisions will impact of course, but with production cuts extended into 2025 with little impact in holding up price to date is noteworthy.

Some experts suggest that U.S. oil prices could range between $60 and $70, with a possibility of dropping to $50 in a price war scenario or further evidence of economic slowdown.

Further Chinese stimulus measures could support price in the medium term if implemented.

In summary

As you can see from the above there are common threads” (e.g. USD strength, relative economic decline), and idiosyncrasies in each of the major commodities.

Whether a trader or investor in commodity futures or companies in that sector the impact has and may continue to be significant going forward of some of the issues discussed above.

It is therefore your responsibility to not only keep abreast of price movements but changes in some of the key factors outlined in this article.

Of course, GO Markets is always here to help with our extensive updates and live events that may offer insight to help you in your commodity exposure decision making.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Uranium’s Turning Point?

Yellowcake - a commodity that is loved and loathed all in the same breath. The questions we have been asking are - which is right and what’s the outlook? Because as traders and investors that dilemma is key, there is a gap here and that leads to volatility and incorrect pricing in the short and long term some may want to jump on. Recent develo...

November 20, 2024Read More >Previous Article

Drill, Drill, Drill Baby – Oil in the next world order

There has been plenty of conjecture about where oil is going to go in 2025 and we would suggest that the recent climb in Brent crude oil prices above ...

November 15, 2024Read More >Please share your location to continue.

Check our help guide for more info.