- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Accenture latest results announced

- 1 Month -3.00%

- 3 Month -13.07%

- Year-to-date -31.78%

- 1 Year -3.01%

- Deutsche Bank $364

- Cowen & Co. $330

- Baird $340

- Morgan Stanley $390

- RBC Capital $435

- Goldman Sachs $386

- Barclays $455

News & AnalysisAccenture (ACN) reported its latest financial results before the market open in the US on Thursday.

The Irish-American professional services company reported revenue of $16.159 billion for the third quarter of fiscal 2022 vs. $16.04 billion expected.

Earnings per share missed analyst expectations for the quarter at $2.79 per share vs. $2.86 per share estimate.

”Our very strong financial results for the third quarter reflect continued broad-based demand across markets, services, and industries, and the continued recognition of the outstanding talent of our 710,000 people. We continue to gain significant market share, and our services have never been more relevant as our clients turn to us as the trusted partner for the solutions they need to accelerate growth and become more resilient and efficient,” Julie Sweet, CEO of the company said in a press release after the earnings announcement.

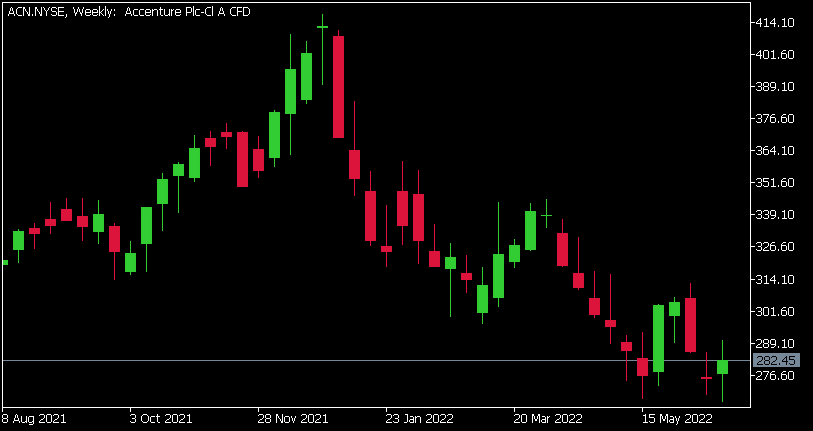

Accenture (ACN) chart

Shares of Accenture were down by around 1% during the trading day on Thursday at $282.45 per share.

Here is how the stock has performed in the past year:

Accenture price targets

Accenture is the 52nd largest company in the world with a market cap of $179.21 billion.

You can trade Accenture (ACN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Accenture, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Lithium darlings fall to 6 months lows.

Two junior lithium companies, Core Lithium, (CXO) and Lake Resources, (LKE) have seen aggressive sell offs after motoric rises in the last few years. The Backstory Lithium stocks companies had seen a momentous rise in the past 3 years largely on the back of the push towards renewable energy and electric vehicles which require lithium for th...

June 24, 2022Read More >Previous Article

Bitcoin teetering above key $20,000 level

Bitcoin and other cryptocurrencies have seen their prices decline rapidly in recent times as inflation has wreaked havoc across the market. The capitu...

June 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.