- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Apple breaks down below key level in pre-market on China iPhone ban woes

- Home

- News & Analysis

- Shares and Indices

- Apple breaks down below key level in pre-market on China iPhone ban woes

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisApple breaks down below key level in pre-market on China iPhone ban woes

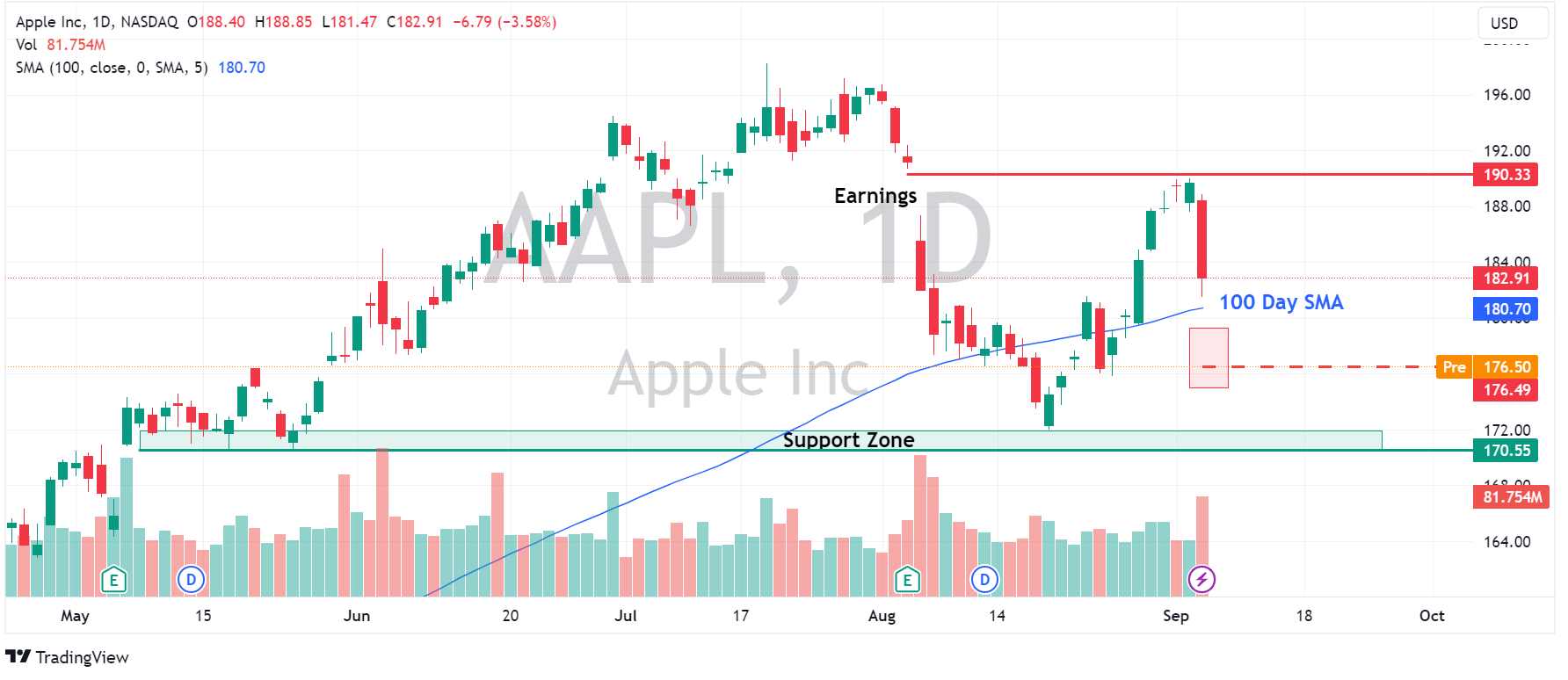

7 September 2023 By Lachlan MeakinA -3.5% slide in AAPL stock price pre-market is seeing the tech giant looking to continue this weeks sell-off after a Bloomberg report that Chinese authorities plan to broaden iPhone restrictions to a number of state-owned companies and other government-affiliated entities. This comes after Wednesday saw the largest one day drop in AAPL stock in over month after the initial plans for the Chinese ban was reported by the Wall St Journal.

The Chinese-US tech war seems to be escalating as China attempts to prop up it’s domestic chip makers in the face of US sanctions and reduce its reliance on Western technology, with AAPL an unwitting victim.

AAPL technical analysis:

The pre-market currently is showing an AAPL open price of 176.50 a hefty 3.5% lower from yesterdays close of 182.91, this will see the price open below the key technical level of the 100 Day MA and making 8 day lows. Coming into play as well will be the support level of the August lows, after a down move started by a disappointing earnings report in early August. Another key level to the upside is the resistance level of the earnings gap fill, where a rally in AAPL stalled before this recent China induced sell-off.

As dire as the chart looks at the moment, there is some good news for AAPL bulls with some analysts seeing this sell-off as an overreaction as the Chinese ban will only effect 500,000 out of 45M iPhones after AAPL has seen massive share gains recently of the Chinese smartphone market.

If we see support at and a hold of the post earnings August lows, a rebound in AAPL is certainly on the cards.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

EU / UK open FX analysis – AUD, JPY, USD, EUR

EU and UK indices are looking to open slightly stronger despite a weak lead from the Asian session. Aussie and Asian indices finish in the red after US-China tech-related frictions and disappointing Japanese GDP revisions weighed on risk sentiment. Asian session wrap - FX Markets The USD was softer with DXY retreating from extreme RSI overbou...

September 8, 2023Read More >Previous Article

USD/CAD failed to break resistance as BoC keeps rates on hold

The USD/CAD pair experienced a relatively uneventful session after Bank of Canada (BoC) decided to keep interest rates on hold. However, what caught ...

September 7, 2023Read More >Please share your location to continue.

Check our help guide for more info.