- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Barrick Gold beats Q2 estimates – sends the stock price higher

- Home

- News & Analysis

- Shares and Indices

- Barrick Gold beats Q2 estimates – sends the stock price higher

- 1 month -4.18%

- 3 months -24.29%

- Year-to-date -14.37%

- 1 year -20.87%

- Barclays $25

- Jefferies $24

- UBS $34

- Deutsche Bank $35

- Credit Suisse $22

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBarrick Gold Corporation (GOLD) reported its latest financial results before the market open in the US on Monday.

One of the world’s largest gold producers reported revenue of $2.874 billion vs. $1.178 billion expected.

The Canadian company reported earnings per share of $0.24 per share for Q2, also beating analyst estimate of $0.23 per share.

”A stronger Q2 performance across the portfolio has kept Barrick on course to achieve its annual gold and copper production guidance while continuing to progress its key growth projects.”

”Gold production for the quarter was higher than Q1 at 1.04 million ounces — driven mainly by Carlin and Turquoise Ridge in Nevada, Veladero in Argentina, and Bulyanhulu and North Mara in Tanzania — and is expected to grow further in the second half of the year. Copper production came to 120 million pounds.”

”A dividend of $0.20 per share was declared for the quarter on the back of the strong operating performance and net cash of $636 million. During the quarter, Barrick repurchased $182 million in shares under the $1 billion share buyback scheme introduced earlier this year,” the company wrote in a press release.

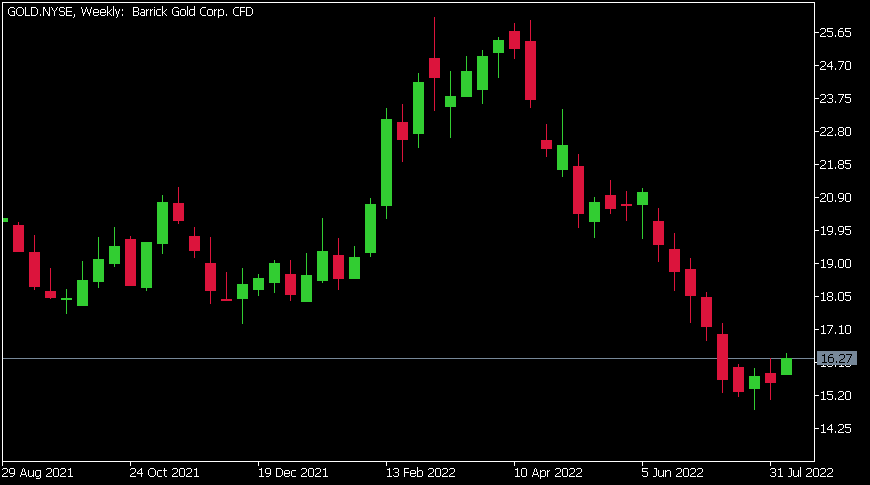

Barrick Gold Corporation (GOLD) chart

The stock price rose on Monday, up by around 5% at $16.27 per share.

Here is how the stock has performed in the past year:

Barrick Gold price targets

Barrick Gold Corporation is the 608th largest company in the world with a market cap of $29.08 billion.

You can trade Barrick Gold Corporation (GOLD) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Barrick Gold Corporation, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Oil Companies Record Profits in question

In a time when you consumers could potentially be feeling domestic budgets tighten up, by the result of surging high inflation and rise in prices of commodities, you would be forgiven to be receiving the news that some of the biggest oil companies in the world, have acquired record profits with some skepticism, you would even question if these ...

August 9, 2022Read More >Previous Article

BNPL sector showing signs of a reversal after monstrous selloff

The Buy Now Pay Later, (BNPL) sector has seen a resurgence after a long and brutal sell-off. The reason for, much of the resurgenc...

August 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.