- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Barrick Gold Q4 results beat estimates

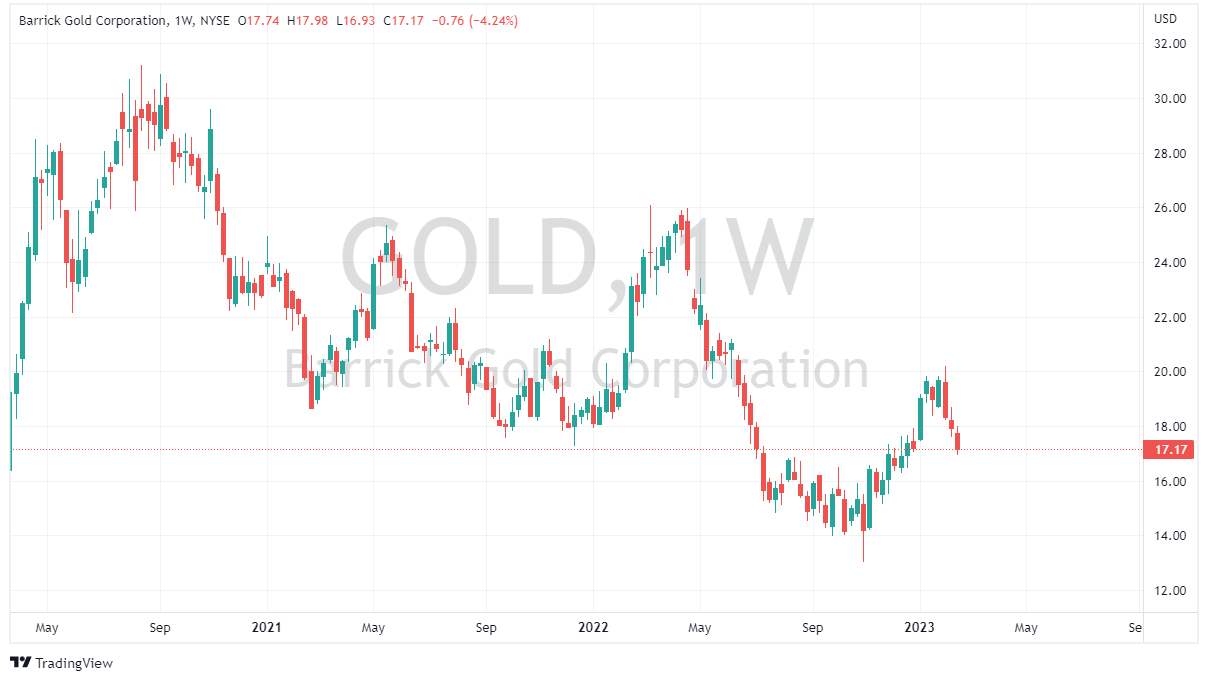

- 1 month: -3.10%

- 3 months: +12.79%

- Year-to-date: +3.67%

- 1 year: -19.88%

- BNP Paribas: $19

- Barclays: $26

- RBC Capital: $20

- Goldman Sachs: $18

- BMO Capital: $28

News & AnalysisBarrick Gold Corporation (NYSE:GOLD) released the latest financial results for Q4 2022 on Wednesday.

The Canadian mining company beat both revenue and earnings per share (EPS) for a second consecutive quarter.

Barrick Gold reported revenue of $2.726 billion for the quarter vs. $2.674 billion expected.

EPS reported at $0.128 per share vs. $0.111 EPS estimate.

The company also announced a dividend of $0.10 per share for Q4 2022.

”Our continued success in not only replenishing but also unlocking significant value in our asset base shows the unmatched potential of our organic growth pipeline,” CEO of Barrick, Mark Bristow said in a press release.

”A stronger Q4 operational performance, notably from Cortez and Carlin in Nevada, Pueblo Viejo in the Dominican Republic and Tongon in Côte d’Ivoire, contributed to annual gold production of more than 4.1 million ounces in a year impacted by infrastructural issues at Turquoise Ridge in Nevada and the replacement of the rock winder at Kibali in the Democratic Republic of Congo. Copper production from Lumwana in Zambia and Jabal Sayid in Saudi Arabia was well within guidance.”

The company also announced another share buyback program: ”Barrick returned a record $1.6 billion to shareholders in 2022 through dividends and share buybacks and has announced a further share buyback program of up to $1 billion for the next twelve months.”

Stock reaction

The stock was down by around 3% at the open in the US at $17.22 as share.

Stock performance

Barrick Gold stock price targets

Barrick Gold is the 572nd largest company in the world with a market cap of $31.38 billion.

You can trade Barrick Gold Corporation (NYSE:GOLD) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Barrick Gold Corporation, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

US Dollar Index technical and fundamental analysis

US Dollar Index Fundamental Analysis A hard-fought tug-of-war between bulls and bears played out on the DXY Index after U.S. inflation data crossed the wires. A knee-jerk reaction caused the greenback to plunge, but eventually it was able to recover and move into positive territory due to higher Treasury yields (DXY +0.10% to 103.41). However...

February 16, 2023Read More >Previous Article

Airbnb sets a new Q4 record – the stock is up

Airbnb Inc. (NASDAQ:ABNB) announced Q4 2022 and 2022 full year financial results after the market close in the US on Tuesday. World’s second larg...

February 15, 2023Read More >Please share your location to continue.

Check our help guide for more info.