- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Broadcom beats Wall Street expectations

- Founded: 1961

- Headquarters: San Jose, California, United States

- Number of employees: 20,000 (2023)

- Industry: Semiconductor, computer software

- Key people: Henry Samueli (Chairman), Hock Tan (President and CEO)

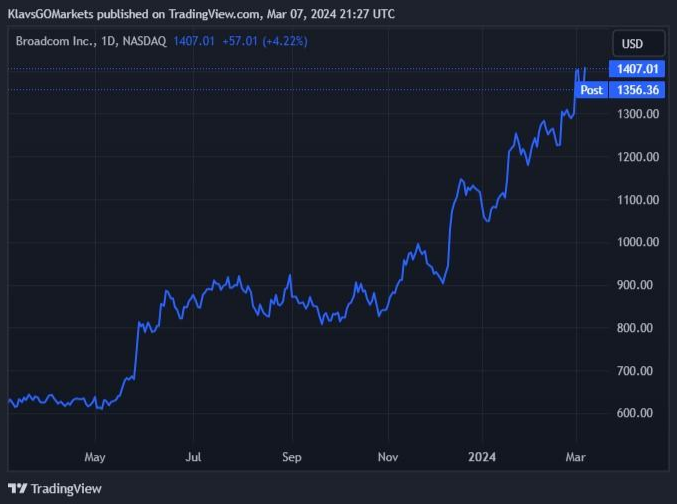

- 5 day: +7.19%

- 1 month: +9.35%

- 3 months: +51.15%

- Year-to-date: +24.88%

- 1 year: +123.92%

- Mizuho: $1,550

- Rosenblatt Securities: $1,500

- Cantor Fitzergald: $1,600

- Oppenheimer: $1,500

- Susquehanna: $1,550

- UBS Group: $1,480

- The Goldman Sachs Group: $1,325

- Citigroup: $1,100

- TD Cowen: $1,000

- Truist Financial: $1,015

- KeyCorp: $1,200

- Evercore ISI: $1,050

- Robert W. Baird: $1,000

- Deutsche Bank: $950

- Wells Fargo & Company: $900

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisBroadcom Inc. (NASDAQ: AVGO) announced its latest financial results after the US market closed on Thursday.

The US tech giant achieved revenue of $11.961 billion in the first quarter of fiscal year 2024 (up by 34% year-over-year) vs. $11.759 billion estimate.

Earnings per share was reported at $10.99 (up by 6.38% year-over-year) vs. $10.368 per share expected.

The company announced a quarterly dividend of $5.25 a share.

Company overview

CEO commentary

Hock Tan, CEO of Broadcom had this to say in a letter to investors: “We are pleased to have two strong drivers of revenue growth for Broadcom in the first quarter and fiscal year 2024. First, our acquisition of VMware is accelerating revenue growth in our infrastructure software segment, as customers deploy VMware Cloud Foundation. Second, strong demand for our networking products in AI data centers, as well as custom AI accelerators from hyperscalers, are driving growth in our semiconductor segment.”

“We reiterate our fiscal year 2024 guidance for consolidated revenue of $50 billion and adjusted EBITDA of $30 billion,” Tan looked at the year ahead.

Stock reaction

Shares ended Thursday’s session up by 4.22% before the results were announced, trading at $1,407.01 a share.

The stock dipped by around 3% in the after-hours trading.

Stock performance

Broadcom stock price targets

Broadcom Inc. is the 11th largest company in the world with a market cap of $646.85 billion, according to CompaniesMarketCap.

You can trade Broadcom Inc. (NASDAQ: AVGO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to “Trading” then select”Share CFDs”.

GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours?

Sources: Broadcom Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Costco tops EPS but falls short on revenue

Broadcom Inc. (NASDAQ: AVGO) wasn’t the only company releasing the latest earnings report on Thursday. World’s second largest supermarket chain Costco Wholesale Corporation (NASDAQ: COST) also announced their results after the closing bell on Wall Street. Costco reported revenue of $57.33 billion vs. $59.111 billion expected. Revenue rose...

March 8, 2024Read More >Previous Article

JD.com earnings announced – the stock is up

It hasn’t been the best start to 2024 for JD.com Inc. (NASDAQ: JD) with the stock down by over 14%. On Wednesday, the Chinese e-commerce company ...

March 7, 2024Read More >Please share your location to continue.

Check our help guide for more info.