- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Mastercard Q4 results announced

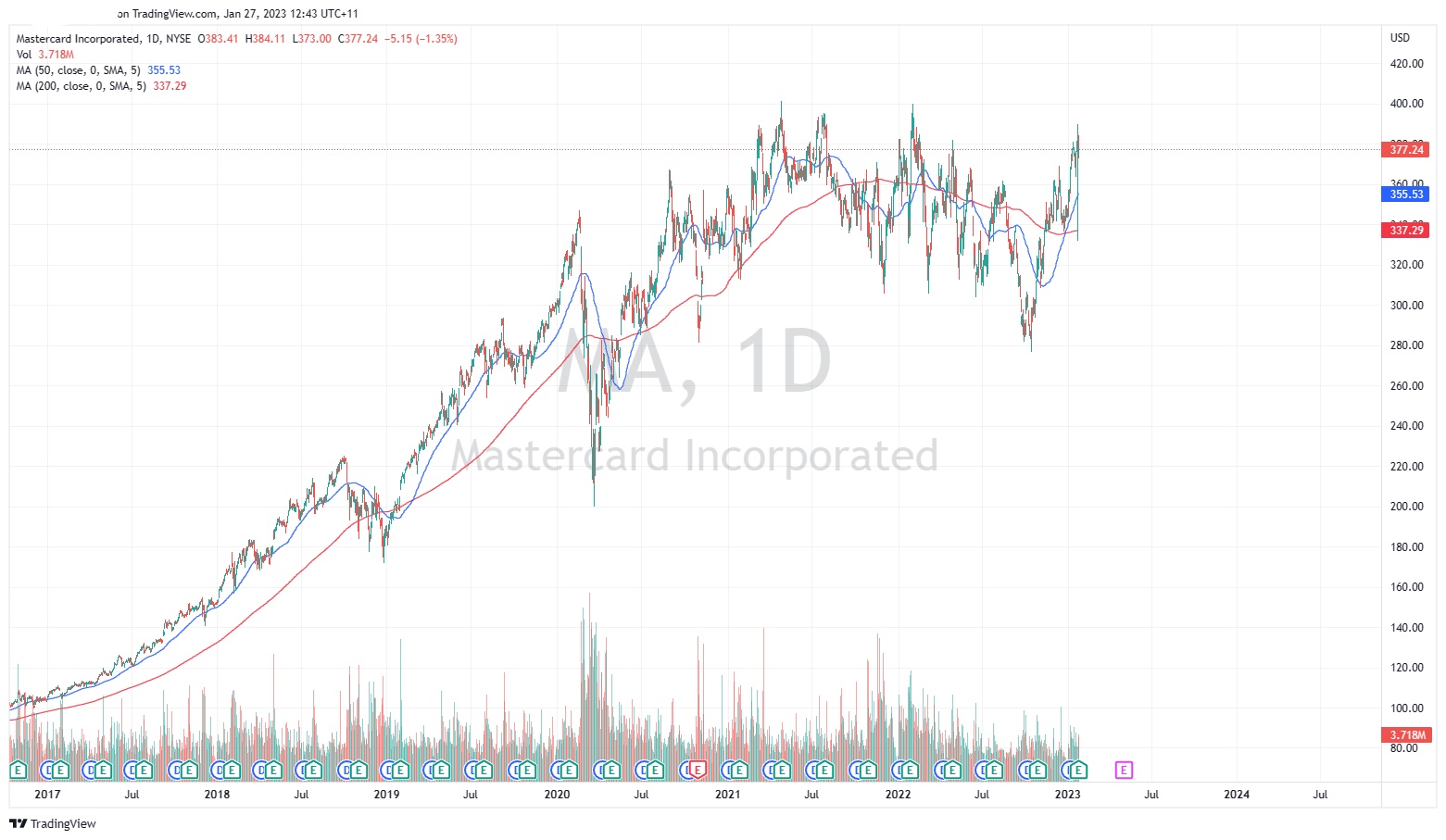

- 1 month: +7.91%

- 3 months: +17.65%

- Year-to-date: +8.06%

- 1 year: +7.19%

- Baird: $410

- Barclays: $427

- Truist Securities: $450

- Jefferies: $430

- Keybanc: $425

- UBS: $441

- Wells Fargo: $405

- Mizuho: $380

- Morgan Stanley: $437

News & AnalysisMastercard Inc. (NYSE: MA) announced the latest financial results for the previous quarter before the market open on Thursday.

World’s third largest financial services company beat both revenue and earnings per share (EPS) estimates for Q4 2022.

The company reported revenue of $5.817 billion vs. $5.793 billion estimate.

EPS at $2.65 per share in Q4 vs. $2.575 per share expected.

CEO commentary

”We closed out the year with strong financial results and notable wins which will help us capitalize on the tremendous secular shift to digital payments,” Michael Miebach, CEO of the company said in a press release.

”As we look at the broader economy, we see the continued recovery of cross-border travel, with volumes up 59% versus a year ago and we’re encouraged by Asia opening up further. While macroeconomic and geopolitical uncertainty persists, consumer spending has been remarkably resilient. We are well prepared to adjust our investment profile quickly if needed,” Miebach concluded.

Stock reaction

Share price of Mastercard dipped by around 2% on Thursday, trading at around $374 a share.

Stock performance

Mastercard stock price targets

Mastercard is the 19th largest company in the world with a market cap of $363.31 billion.

You can trade Mastercard Inc. (NYSE: MA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Mastercard Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

AUD hits $0.71 for first time since August 2022

The Australian dollar has continued its rise against the USD reaching the highest level in almost 3 months. With risk on assets receiving a boost and the USD weakening the Australian dollar has been a big beneficiary. As hopes for a Federal Reserve pivot increase the greenback has seen aa pullback and growth assets have seen an influx of money. Wit...

January 27, 2023Read More >Previous Article

Tesla posts mixed Q4 results

Tesla Inc. (NASDAQ: TSLA) reported Q4 2022 financial results after the market close in the US on Wednesday. World’s largest automaker reported re...

January 26, 2023Read More >Please share your location to continue.

Check our help guide for more info.