- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

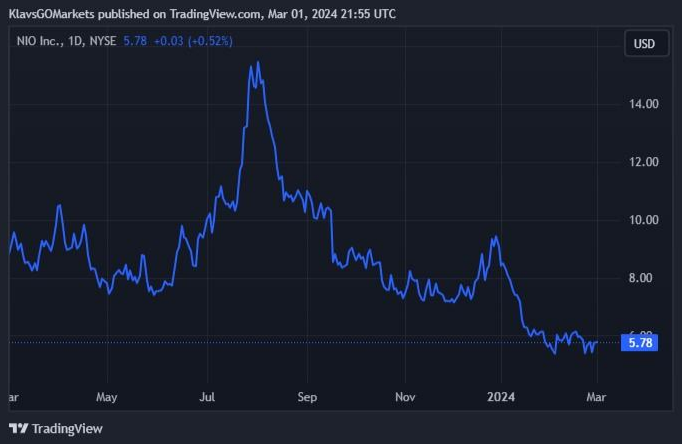

- NIO deliveries fall year-over-year

- Founded: November 2014

- Headquarters: Shanghai, China

- Number of employees: 20,000+ (2023)

- Industry: Automotive

- Key people: William Li (CEO), Lihong Qin (President), Wei Feng (CFO)

- 5 day: +7.69%

- 1 month: +4.96%

- 3 months: -18.67%

- Year-to-date: -35.89%

- 1 year: -39.24%

- Mizuho: $15

- Deutsche Bank: $16

- CLSA: $14

- Sanford C. Bernstein: $8

- JP Morgan Chase & Co.: $5

- Citigroup: $19.20

- UBS Group: $15

- Nomura: $7.50

- Barclays: $8

- Morgan Stanley: $12

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisNIO Inc. (NYSE: NIO) has had a terrible start to 2024 with the stock plummeting by over 35% year-to-date.

On 23/2/24, JP Morgan Chase & Co. downgraded its price target for NIO from $8.50 to $5 a share, citing “weakness to the company’s slow sales in January and investor concern on the company’s sales and earnings momentum in 2024.”

On Friday, the Chinese electric vehicle manufacturer released the latest delivery data for February.

The company delivered a total of 8,132 cars last month, down from 12,157 deliveries in February 2022.

NIO has delivered 467,781 vehicles in total as of 29/2/24.

The EV maker will announce the latest financial results for Q4 2023 before the US market open on 5/3/24.

Company overview

Stock reaction

The stock was up by 0.52% at the end of Friday’s session at $5.78 a share.

Stock performance

NIO stock price targets

NIO Inc. is the 1395th largest and 4th largest electric vehicle company in the world with a market cap of $12.09 billion.

You can trade NIO Inc. (NYSE: NIO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD.

GO Markets now offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time.

Why trade during extended hours?

Sources: NIO Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX analysis – Gold hits new closing high, USDJPY holds above 150, DXY flat despite rising yields

Gold surged again in Monday’s session despite a rise in US Treasury yields and setting a new closing high. There was little fundamental news to drive the rally though a comparable surge in the Crypto markets has seemingly given the other “alternative” currency a tailwind. This is four up sessions for gold and with momentum behind it is eyeing...

March 5, 2024Read More >Previous Article

Hewlett Packard stock dips after mixed quarterly results

Hewlett Packard Enterprise Company (NYSE: HPE) released earnings results for Q1 of fiscal 2024 after the US market closed on Thursday. The American...

March 1, 2024Read More >Please share your location to continue.

Check our help guide for more info.