- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- NIO Q4 2023 and full-year results are here

- Founded: November 2014

- Headquarters: Shanghai, China

- Number of employees: 20,000+ (2023)

- Industry: Automotive

- Key people: William Li (CEO), Lihong Qin (President), Wei Feng (CFO)

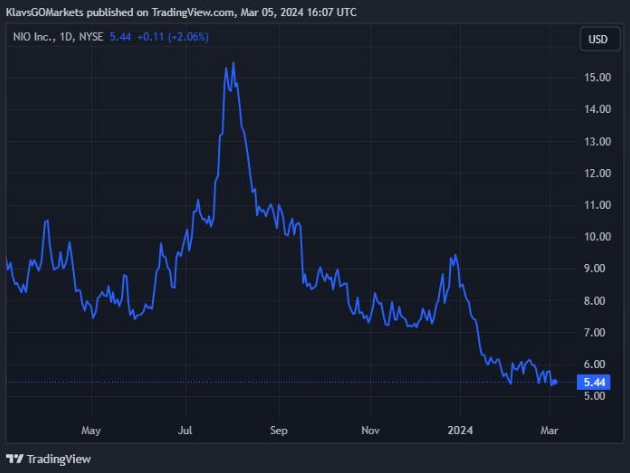

- 5 day: -5.28%

- 1 month: -9.20%

- 3 months: -26.31%

- Year-to-date: -39.64%

- 1 year: -38.96%

- Mizuho: $15

- Deutsche Bank: $16

- CLSA: $14

- Sanford C. Bernstein: $8

- JP Morgan Chase & Co.: $5

- Citigroup: $19.20

- UBS Group: $15

- Nomura: $7.50

- Barclays: $8

- Morgan Stanley: $12

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & AnalysisLast week, Chinese electric vehicle manufacturer NIO Inc. (NYSE: NIO) released its latest delivery numbers for February. On Tuesday, it was time for the company to announce Q4 2023 and full-year financial results. Let’s take a closer look at how the company performed.

NIO achieved revenue of $2.409 billion for the last three months of 2023, which fell below Wall Street estimate of $2.558 billion. Revenue was up by 6.5% year-over-year.

The company reported loss per share of -$0.396, which was more than -$0.337 loss per share expected.

Full year revenue reached $7.833 billion in 2023, up from 7.143 billion the year prior.

Company overview

CEO commentary

“In 2023, NIO set a new delivery record of 160,038 vehicles, ranking first in China’s premium BEV market with an average transaction price over RMB 300,000. At NIO Day 2023, we unveiled ET9, our smart electric executive flagship, showcasing a suite of our latest technologies, including our self-developed AD chip, full-domain 900V architecture, advanced intelligent chassis system and various other industry-leading innovations,” CEO of NIO, William Li said in a statement to shareholders.

“We will soon start deliveries of 2024 NIO products equipped with the highest computing power among production vehicles and constantly enhance users’ driving and digital experience. Meanwhile, we plan to release Navigate on Pilot Plus (NOP+) for urban roads to all NT2.0 users in the second quarter. Our continuous investments in technologies, battery swapping network and user community will bolster our competitive advantages as we navigate the future competition,” Li finished his statement.

Stock reaction

Shares were up by around 2% on Tuesday, trading at $5.44.

Stock performance

NIO stock price targets

NIO Inc. is the 1369th largest and 4th largest electric vehicle company in the world with a market cap of $12.38 billion.

You can trade NIO Inc. (NYSE: NIO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD.

GO Markets now offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time.

Why trade during extended hours?

Sources: NIO Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX Analysis – Risk-off sees Gold soar to all time highs, Yen outperforms after hot CPI

Risk off returned to the markets in Tuesdays session with US equity markets pulling back sharply led by tech stocks with the NASDAQ being the biggest loser, shedding 1.65%. The big headline for the day in FX was gold touching on all-time highs, rallying for a fifth straight session, buoyed by haven flows and a drop in US treasury yields. XAUUSD ...

March 6, 2024Read More >Previous Article

Target stock rallies as earnings exceed expectations

American supermarket chain Target Corporation (NYSE: TGT) announced the latest earnings results before the opening bell on Wall Street on Tuesday. ...

March 6, 2024Read More >Please share your location to continue.

Check our help guide for more info.