- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Short Term Break Out on the S&P500

News & AnalysisThe S&P 500 has been battered and bruised in one of the worst first half of the years in history. However, there are some signs that it may be turning.

A short term long buying opportunity on the SPY looks to be apparent. With the recent bullish sentiment due to the market believing that much of the forecast slowing growth and interest rate hikes have been prices into the market already.

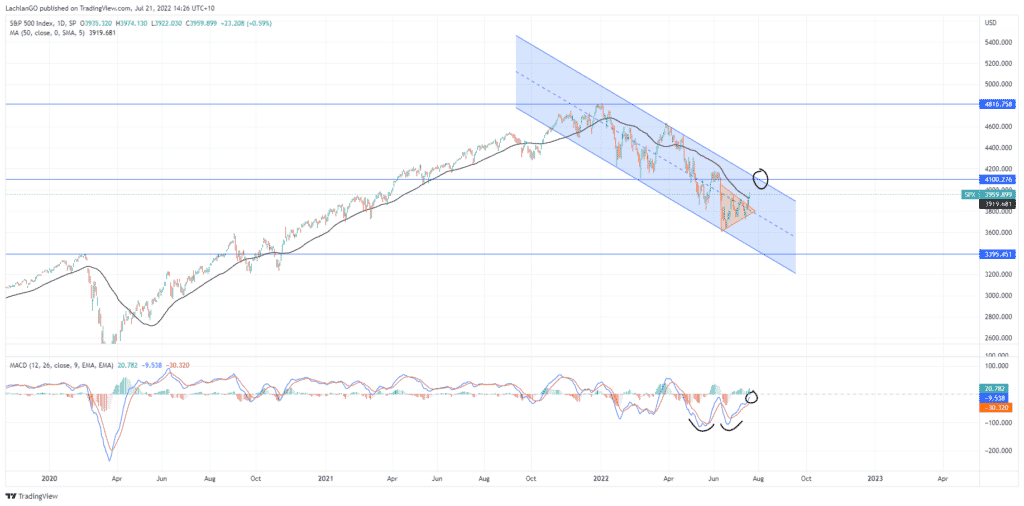

The trading opportunity is a technical breakout of a wedge pattern on the daily chart. Firstly it is important to recognise that the S&P500 is still in a longer term down trend. This can be seen on the chart below. Since December 2021 the SPX has been in a downward channel making a series of lower highs and lower lows. Therefore it is important to understand that this opportunity will be against the longer general trend of the market.

The Chart

On the chart the wedge at the bottom of the channel has broken to the upside. Without this break it could’ve been possible that this would’ve formed into a bear flag. However on the contrary, it looks to have developed into a reversal pattern, as the price has coiled. Furthermore, and importantly, the price has broken above the 50 day average. This is also supported by the MACD. The MACD is not just showing a crossover. To add support to the reversal, the MACD is showing a double bottom pattern of exhaustion as it looks to break over the zero line for the first time since April.

A conservative target would be the convergence of the next level of resistance and also the top line of the channel. This is a 4100 target. If the index can break through 4100 level and continue to rise to 4230. As stated previously the second move up will likely face a large amount of resistance as it is fighting the general trend and against a fairly strong resistance point

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Is the AUDUSD ready to reverse?

Recent History The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and recession fears have seen investors turn to the USD whilst at the same time taking off risk from the AUD. The AUD's drop has also been further is largely due to a decrease in the price of commodities...

July 21, 2022Read More >Previous Article

Market jumps on the back of weak USD and better then expected earnings

The US stock market saw one of its best days in months, as speculation swirled that the 'bottom' may be in. The indices gained their momentum from bet...

July 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.