- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Target falls short in Q2 – the stock is down

- Home

- News & Analysis

- Shares and Indices

- Target falls short in Q2 – the stock is down

- 1 month +12.04%

- 3 months +8.50%

- Year-to-date -24.24%

- 1 year -29.18%

- JP Morgan $190

- Wells Fargo $195

- Piper Sandler $190

- Barclays $175

- UBS $205

- Deutsche Bank $198

- Morgan Stanley $190

- Goldman Sachs $171

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisTarget Corporation (TGT) reported its second quarter earnings results before the opening bell on Wall Street on Wednesday.

The US retailer reported revenue of $26.037 billion (up 3.5% year-over-year), which was slightly above analyst estimate of $26.032 billion.

Earnings per share reported at $0.39 per share (down 89.2% year-over-year) vs. $0.79 per share expected.

”I’m really pleased with the underlying performance of our business, which continues to grow traffic and sales while delivering broad-based unit-share gains in a very challenging environment,” Brian Cornell, chairman and CEO of Target Corporation commented on the second quarter results.

”I want to thank our team for their tireless work to deliver on the inventory rightsizing goals we announced in June. While these inventory actions put significant pressure on our near-term profitability, we’re confident this was the right long-term decision in support of our guests, our team and our business. Looking ahead, the team is energized and ready to serve our guests in the back half of the year, with a safe, clean, uncluttered shopping experience, compelling value across every category, and a fresh assortment to serve our guests’ wants and needs,” Cornell concluded.

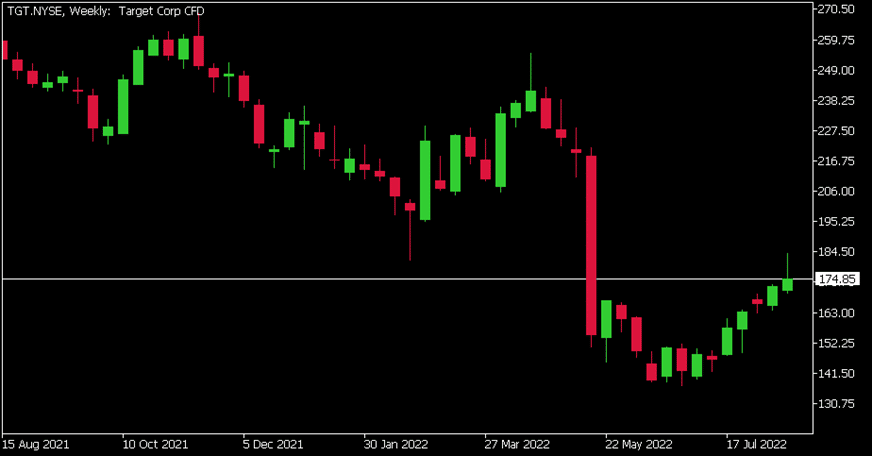

Target Corporation (TGT) chart

The stock was down by 2.69% on Wednesday at $174.85 per share.

Here is how the stock has performed in the past year:

Target price targets

Target Corporation is the 166th largest company in the world with a market cap of $81.37 billion.

You can trade Target Corporation (TGT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Target Corporation, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

AUD drops on Employment Figures

The Aussie Dollar has seen a drop in its price due to wage and unemployment data released over the past day and a half. The economic data shows that unemployment has fallen to its lowest level in nearly 50 years with the jobless rate at 3.4% compared to analysts expecting the figure to remain at 3.5%. Wages also rose modestly in the last quarter to...

August 18, 2022Read More >Previous Article

Walmart tops expectations for Q2 – the stock is up

Walmart tops expectations for Q2 – the stock is up Walmart Inc. (WMT) announced its Q2 financial results before the market open on Wall Street on...

August 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.