- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- TSMC posts strong Q4 results – the stock is rising

- Home

- News & Analysis

- Shares and Indices

- TSMC posts strong Q4 results – the stock is rising

- 1 month:

- 3 months:

- Year-to-date:

- 1 year:

- Susquehanna: $88

- Atlantic Equities: $170

- Cowen & Co.: $120

- Argus Research: $150

- Goldman Sachs: $55

News & AnalysisNews & Analysis

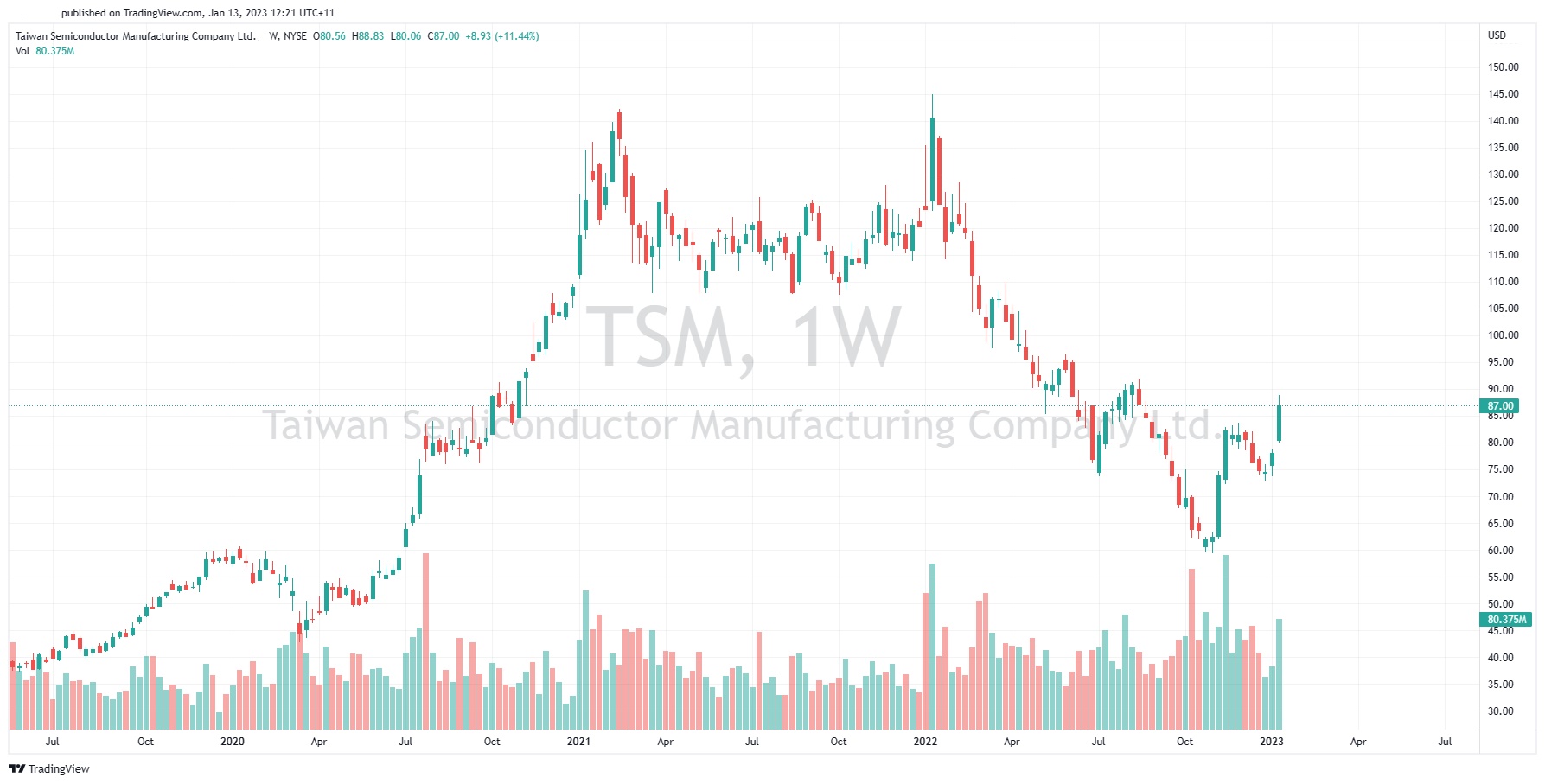

News & AnalysisNews & AnalysisTSMC posts strong Q4 results – the stock is rising

Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) reported Q4 financial results before the market open in the US on Thursday.

The Taiwanese company reported revenue of $20.554 billion for Q4, falling slightly short of Wall Street estimate of $20.574 billion.

TSMC reported earnings per share (EPS) of $1.875% for the quarter, higher than $1.795 EPS expected.

CFO commentary

”Our fourth quarter business was dampened by end market demand softness, and customers’ inventory adjustment, despite the continued ramp-up for our industry-leading 5nm technologies,” Wendell Huang, VP and CFO said after the results.

”Moving into first quarter 2023, as overall macroeconomic conditions remain weak, we expect our business to be further impacted by continued end market demand softness, and customers’ further inventory adjustment,” Huang looked ahead.

The company expects the revenue of between $16.7 billion and $17.5 billion for Q1.

Stock reaction

Shares of TSMC were up by over 7% on Thursday at $88.07 a share.

Stock performance

TSMC price targets

Taiwan Semiconductor Manufacturing Company Limited is the 10th largest company in the world with a market cap of $454.97 billion.

You can trade Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Taiwan Semiconductor Manufacturing Company Limited, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Is the ASX heading toward all-time highs?

The outlook for the Australian equities market is one of the best globally and is see up to cope with a potential recession. The Australian market showed itself to be robust in much of the volatility and downturn of last year being one of the more solid economies. This relative strength has carried so far into 2023 and has largely been due to th...

January 17, 2023Read More >Previous Article

Bitcoin showing early signs of another sell off?

Bitcoin had a tumultuous 2022 with the leading cryptocurrency seeing an aggressive sell off. Lead by catalyst such including the collapse of Celsius a...

January 12, 2023Read More >Please share your location to continue.

Check our help guide for more info.