- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Twiggy’s Beefy Winner

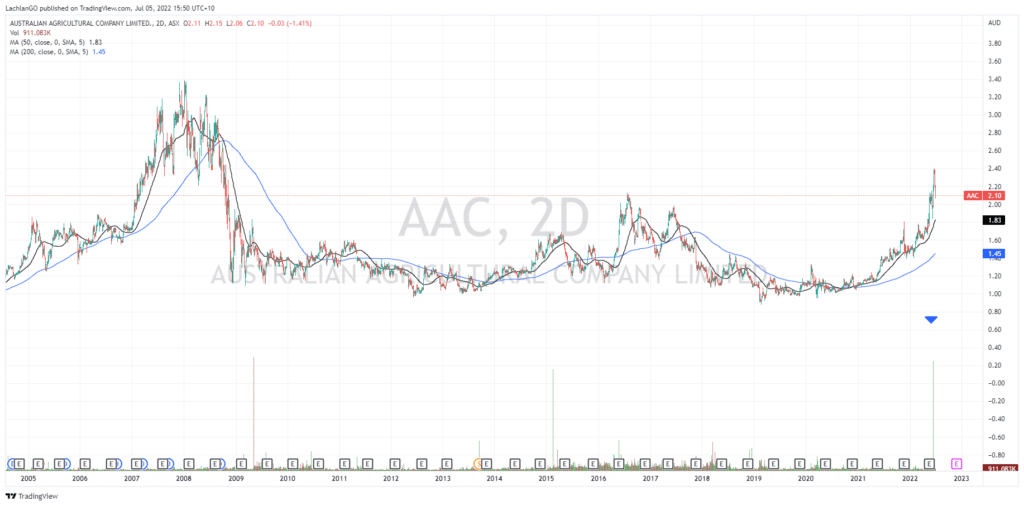

News & AnalysisAndrew ‘Twiggy’ Forrest has bet on a winner in Australian Agricultural Company (AAC). The company is Australia’s largest integrated cattle and beef producer and is recognised as the oldest continuously operating company in Australia.

In recent week’s key investment figure, Twiggy Forrest through his investment company Tattering, has doubled its holding from 8.97% to 17.4% at a cost of approximately $122 million making it a substantial holder. The old investing and trading adage is that you should always follow the big money, and, in this case, the big money could not be much bigger then Twiggy.

Company Overview

AAC operations consist of properties, feedlots, and farms on around 6.4 million hectares of land in QLD and the Northern Territory representing almost 1% of all land mass in Australia. The company then exports the beef to key markets globally. The company currently has a market capitalisation of $1.28 Billion and a share price of $2.11 as of 3pm EST 5 July 2022.

Recent Performance

The company has seen very strong earnings in recent years as they have improved their margins and reduced their costs. In the 2022 year their sales and production volumes dropped off. At the same time Asian and Australian volume were down 21% and 24% respectively which do lead to some concern. With over half of its product being sold in Asia, the Asia pacific region specifically is a pause for concern. However, with the price of Wagyu beef sales increasing by 20%, the company has been able to offset the volume drop off and see revenue remain steady.

Opportunities

The company has been expanding globally and this has seen a high demand for its products internationally. With a 56% increase year on year and a 21% volume increase in sales the USA represents a market that is hungry for AAC and its beef.

The leadership of AAC has shown an impressive ability to minimise costs in times of low profitability and ensure the company does not operate with negative cashflow. According to DataM Intelligence Analysis (2021) The price of Wagu Beef is expected to compound 7% annual for the rest of the decade. These figures bode well for AAC. Management has shown itself to be particularly impressive in reducing costs and improving margins particularly during difficult years during Covid 19. It was able to improve its operating margin by 43% from the prior year showing just how effective it can be.

Weaknesses

With growing inflationary pressures and a global theatre that has seen many disruptions to the supply chain, the potential increase or blowout of costs related to the logistical movement of good may be cause for concern. Particularly with much of its market overseas, the potential for supply chain pressures is great for AAC. In addition, any further border closures, or economic sanctions may prove to be problematic for the company.

Technical Analysis

The company’s share price has seen a significant rise in recent weeks in its price and pure volume of buying. The chart shows a significant coiling of the price as the buying volume was building and the sellers were drying up. The price has also broken through the multi decade high of $2.13 on significant volume. The $2.13 level had added importance as it was also the midpoint of the 20-year range. In recent days the market has retested the $2.10 level but a short/medium term technical target of $3.38 is not out of the question.

In the Long term a price target based on the fundamentals of the company, the increase in price of Beef, management’s history of effective financial management and the growth pathways in the USA and Asia may see the share price rise towards $4.50.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Oil dips to the bottom of its range as recession fears hit the market.

Oil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from the Russian and Ukraine crisis. During the run Oil peaked at $137 a barrel before entering a period of consolidation. The recent catalyst for the drop was OPEC announcing that 2023 would likely re...

July 13, 2022Read More >Previous Article

How to ‘Trade the News’

‘Trading the news’, is a phrase that is often said, but to new traders it can be a confusing statement without much context. What does it mean to ...

July 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.