- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- 6 Practical Steps to Improve Trading Discipline: #3 Create the motivation to consider change

- Home

- News & Analysis

- Trading Strategies, Psychology

- 6 Practical Steps to Improve Trading Discipline: #3 Create the motivation to consider change

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis6 Practical Steps to Improve Trading Discipline: #3 Create the motivation to consider change

6 November 2019 By Mike SmithIn our previous articles we introduced the SIX steps to improving your trading discipline, offered some guidance on developing “awareness” and explored how to prioritise the trading discipline areas. If you haven’t yet read these articles, perhaps it is worth checking them out before moving onto this one.

Step 2 – Prioritise and Identify your cause

This third step aims to take those prioritised areas and create as many compelling reasons to change the thinking from “It would be good to work on” to an “I MUST work on…”.

Why is this necessary?

We all recognise that working on anything to do with your trading, be it a knowledge gap, developing a new system or the on-going commitment of keeping a journal for example will require effort and time. In our busy lives it is sometimes difficult to create this without a compelling reason to do so. We need a perceived level of necessity to enable us to push through and act.Hence the more motivation we can create that this IS a necessity will serve us well in follow through.Adults are invariably motivated to consider change based on perceived level of pleasure or pain of taking action/inaction. If we are comfortable in what we are doing or haven’t got an obvious reason to make this effort and invest the time we will tend to be less motivated to change anything to do with our trading.

Hence, what is being suggested is through identifying the pleasure (or in other words a potential positive impact on trading results or the potential pain (or in other words possible negative outcomes of not acting), this may assist in creating this motivation.

And so, onto the practical

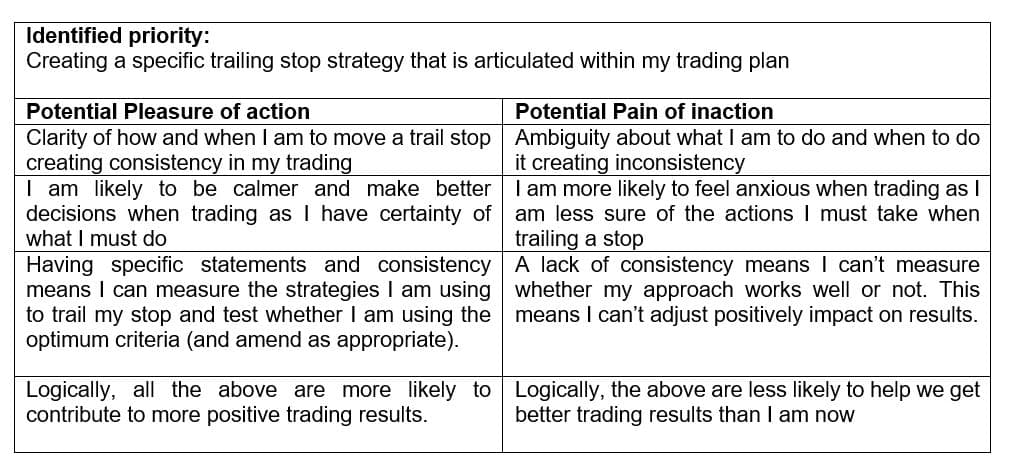

So, this practical step involves this process of quite simply identifying the implications of what you are doing and creating that impetus to act.Let’s use an example to help get you started.

You have identified previously that your “trail stop strategy” within the exit component of your trading plan needs to be written and followed. Now you have a simple statement suggesting “I will trail my stop when a trade goes in my desired direction”.You have recognised that although the idea of trailing a stop is referenced there is a lack of specific instruction as to how you are going to do this.

So, get time to get busy and create that motivation to amend this to better serve you.

Get a piece of paper (or get on your PC and open a word document) and create two sections.In section one you list the potential positive trading outcomes (pleasure) that could result if you DO act.

In section two the potential negative trading outcomes (pain) that could result from NOT acting.

So, it could look something like the table below:

It is worth note that the last statement essentially in a summary statement which references results. This was your impetus for choosing this as a potential priority area and reinforces this psychologically helping you to lock in the importance of addressing this.

Now remember, the purpose of this approach is to get you to take initial action, to ‘press the button: on doing something.

Your next challenge which we will address in the next “discipline steps” article, is about turning this theoretical reason to act into actual execution, and in some cases, with areas that require on-going input, to maintain your required motivation through creating an effective trading habit.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Is Germany on the Brink of a Technical Recession?

Is Germany on the Brink of a Technical Recession? Europe’s largest economy and the world’s fourth-largest economy is at risk of going into a technical recession. Such recession arises after two consecutive quarters of economic decline. In the second quarter of 2019, the German’s economy had contracted by 0.1% compared to a growth of 0.4% ...

November 12, 2019Read More >Previous Article

The MACD – Useful indicator or just another pretty picture?

The MACD (or the ‘Moving Average Convergence/Divergence oscillator’ to give its full name) is one of the popular extra pieces of informa...

November 3, 2019Read More >Please share your location to continue.

Check our help guide for more info.