- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- The Art Of War And Trading: Part 1

- Home

- News & Analysis

- Trading Strategies, Psychology

- The Art Of War And Trading: Part 1

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis What Is The Art Of War?

What Is The Art Of War?The Art of War is an ancient Chinese book on military tactics and strategy who written by Sun Tzu around 500 BC. These writings are considered by many to be the most significant literature on military tactics and wisdom that can be applied to everyday life ever conceived.

In this multi-article series, we will be interpreting this ancient text, and exploring its application to modern day investing and trading. The whole book has 13 chapters and is only 6,000 characters long, which is relatively concise for such an old and complex language. I will be breaking this down into sections, explaining the meaning behind each phrase and how to apply this to your trading style or strategy.

Military Style Trading

Imagine this. You’re sitting in front of your screen opening a candlestick chart and trying to figure out the recent patterns and getting ready to place an order. What if you viewed this chart like a military map? The money in your account is like the soldiers under your command, and the buy or sell orders are like attack or retreat orders.

Can you see what I’m hinting at here? —— Trading and War tactics are both arts and similar in many ways. So why don’t we try absorbing some knowledge from the ancient masterpiece? Perhaps we’ll discover some inspirational gems that we can use in our approach to the financial markets.

Chapter 1: Strategy

Tips: As we progress through the following sections, whenever you see the word “War,” try to replace it with either “Investment” or “Trading” in your head.

Explanation:

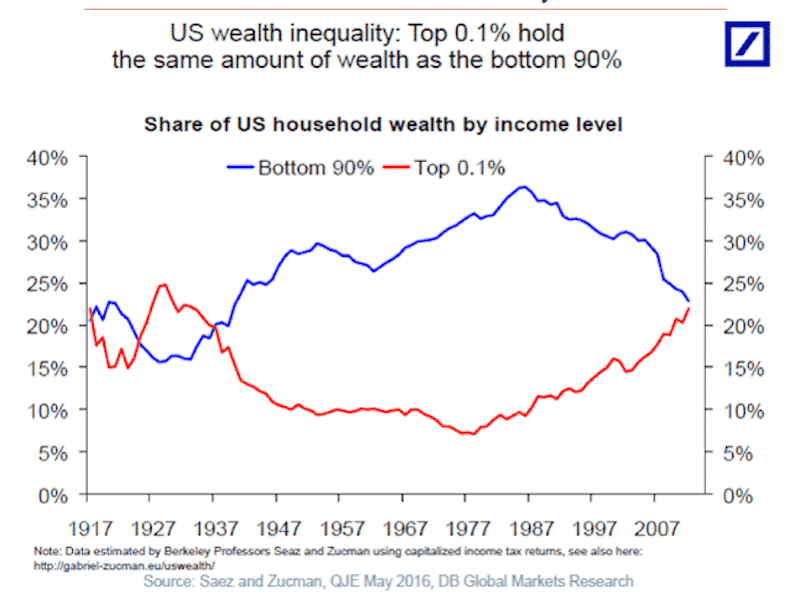

In ancient society, the theory was those who fail to consider strengthening their military force will die. Nowadays, modern society suggests if you ignore investment principles, you will also die, not physically, but perhaps perish in mediocrity. For example, we all know that since 2008, the wealth inequality gap has become much worse. A vast number of billionaires have emerged, while the middle classes are considerably poorer than one decade ago. Different Class Different Mentalities

Different Class Different MentalitiesOne possible explanation behind this is because most rich people tend to invest their money into the stock market or high yielding assets in contrast to the general middle-class who’s mentality is geared towards savings and consumption.

If Sun Tzu were around today, he’d likely suggest investments over savings. The reason for this is because investing can amplify your wealth if managed correctly, but the method of saving money could be considered a slow death.

Death By Inflation

In short, cash in the bank is devalued over time by the act of inflation. While saving money is not necessary a bad thing for some, failing to learn about investing might mean sacrificing opportunities or degrading one’s wealth as its value inevitably starts to erode on the sidelines.

(1) Tao

Explanation:

Tao could represent the basic, intrinsic rules of each investment product.For example, the movement of a currency pair (say GBPUSD) is often affected by the fundamentals, news events (such as Brexit) or even just human behavior.

So how can we trade the intrinsic values as the price is always changing? The answer is to find specific patterns or characteristics that are inherent to whatever product you are trading. To do this, you need to explore all the elements and try to make an informed decision as to the possible move in price.

However, given nobody can predict these moves with 100% accuracy, perhaps the only thing we can do is use the following four factors as a guide to help eliminate bad trading habits, and increase the probability of executing profitable trades.

(2) Time

You can think of this second factor as Fundamentals. As a qualified investor, you should understand what economic data means (such as GDP growth, unemployment, CPI, etc.), What types of events could cause the price to rise and fall (for example you should know how Bond-yield affects the value of USD)

As with the cyclical nature of seasons or knowing the exact time of the sunrise and sunset, fundamentals can provide clues as to when we should place a trade based on the upcoming data. This idea is just like a weather forecaster predicting the chances of rain tomorrow. Keep in mind that the weather, like markets, is not an accurate science and is subject to change.

(3) Earth

Ea

rth or Topography would represent the field of Technical analysis because this method explores the “landform” of a price chart.

rth or Topography would represent the field of Technical analysis because this method explores the “landform” of a price chart.For example, the highs and lows are like highlands and lowlands in battlefields, with support and resistance lines acting as potential grounds to set up an ambush or mount a defense.

By mastering technical analysis, you will be like a commander, studying the geographical features of a map, navigating the terrain and using this knowledge to plan an attack or send reinforcements.

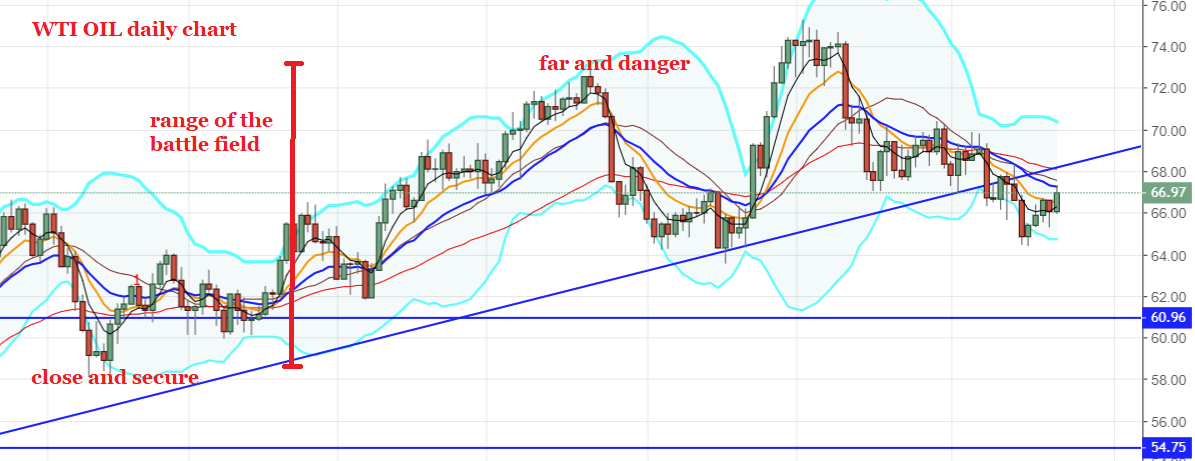

I will use a straightforward chart to illustrate all the factors that mentioned in Sun Tzu’s original text.

From the chart below, we can see the trend of oil prices is going up, and the most obvious move is to look for an area of value. The idea is to place a buy order while the level is relatively low.

When the price approaches the trend line, perhaps this is a safer place an order? On the other hand, when activity reaches the upper band, in the context of Sun Tzu, it might be considered “too far and dangerous” to keep attacking; thus the best move is to retreat (close your position and take your profit).

We’ll be discussing more on topography and technical analysis in further chapters.

(4) Commander

A commander (i.e., investor) should aspire to obtain the characteristics listed above. If any of these traits are missing, Sun Tzu would perhaps suggest you are more vulnerable to trading losses in the future. Thus, Investment is also a process of exercising yourself to become a better person.

(5) Discipline

Discipline involves organizing a set of rules to follow while trading and the text would suggest you should not change these on a discretionary basis. Similar to military orders on a battlefield, it is imperative a commander’s orders are followed and not disobeyed.

In short, without discipline and proper execution, the fundamental and technical analysis that you apply above will be meaningless.

By Lanson Chen – Analyst

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: DB Global Markets Research, “The Art Of War” -Sun Tzu.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Six Attributes of a Good Trading Plan

As a trader, you’ve probably found that having the right trading plan plays a significant role in your trading success. A basic trading plan should tell you what, when and how much to trade. It should also have specific instructions on when to close out your trades. As traders, we all need a well thought out trading plan to navigate our w...

August 28, 2018Read More >Previous Article

Global Oil Sentiment May Assist The Loonie

The US Dollar has been crushing it this week against many of the major currency pairs with most of the market chatter surrounding additional rate hike...

August 24, 2018Read More >Please share your location to continue.

Check our help guide for more info.