- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Trading Strategies, Psychology

- What are Bonds and how do you trade them?

- Home

- News & Analysis

- Trading Strategies, Psychology

- What are Bonds and how do you trade them?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMaturity, Yields, Par Values and Coupon payments. These are words that everyone has heard of but not many have a good understanding of what they mean. In this article all these complicated terms will be explained. Please note that while this information is most relevant for physical bonds, it is still important to understand when dealing with CFD’s as they play an important role in how bond CFD’s are valued.

What is a Bond?

A bond is an instrument that is used by companies and governments and other entities to raise money through the issuing of debt. There are different typed of bonds however, the simplest bonds are contracts in which an issuer (Company/Government) receives a payment from the purchaser or bond holder in exchange for the rights to interest plus the principal amount.

For example, a government may issue a 10-year bond for $1000 in which they agree to pay 1% interest per annum which will equate to $10 per year. In addition, they will pay back the principal amount once the bond matures.

Key Terms

Issuer – The entity that sells the bond initially and must make payments.

Holder – The entity who is possession of the bond.

Principal – The amount of debt that the government/company has taken that will be paid at maturity.

Par Value – The nominal value of the bond or the price when it was issued.

Coupon Payment– The interest payment that is paid to the bond holder.

Yield –The coupon payment divided by the Bonds face value.

Maturity – The date when the principal amount of the bond will be paid back.

Bond Ratings

Generally, Bonds are rated according by agencies, based on how safe the underlying assets are. For instance, government bonds tend to be rated the highest as they are guaranteed by the government, and governments are highly unlikely to default. In a practical sense, the US government is such a reliable issuer that it should never default on the repayments. This makes Bond’s a great asset to act as a hedge against unsystematic risk. On the other hand, corporate bonds may be given lower ratings depending on their credit risks.

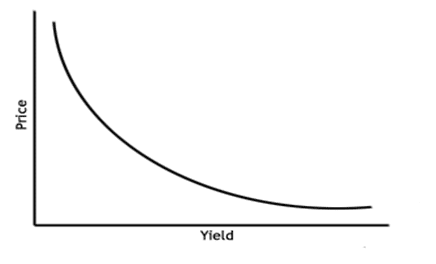

Inverse Relationship between Bond Price and Yield

The price and yields for bonds are inversely related. This is important to note as bonds are often charted against their yield and not price which is how derivatives are often charted. Therefore, a trader should be aware of the inverse relationship between price and yield. This occurs because as the price of a bond changes up or down the interest rate must adjust to ensure that the coupon payment is the same.

Assume Bond A is issued at $1000 dollars and 10% interest rate to pay a $100 coupon.

1 Year later that same bond is now priced at $900, however the bond must still pay out a $100 coupon. However, to get a coupon payment of $100, the interest rate must increase.

The formula below shows this:

$900 x Interest Rate = 100.

Simple Algebra shows that the interest rate = 11.1%

Understanding this relationship will make eliminate one of the more confusing elements of trading bonds.

Catalysts for Bond Prices

The general factors that influence a bond’s price are related to the interest rates and the broader economy. For instance, if the market interest rate 2% and the bond’s coupon rate is 1%, then the bond will trade at a lower price and vice versa. Subsequently, bonds can be a handy way of tracking the sentiment as they often reflect the feeling in the market.

Economic events can impact on the performance of bonds. When the economy is growing and equities are doing well, bonds tend to perform worse as the return is limited. However, during times of volatility and poor stock market performance, the bond market tends to perform better as the market looks for safety in the guaranteed returns from bonds. Inflationary pressure and low or high interest rates can influence the direction of the way in which bonds are traded.

Generally, in a strong economic market, bonds with longer maturities tend to have higher yields than those in shorter maturity. This is generally due to the thought that the time that is further in the future will has more uncertainty than that in the near-term future. The general exception to this is when the market expects a recession soon. This causes what is known as an inverted yield curve, in which the shorter-term bond is yielding a higher interest then the long-term bonds.

You can trade CFD on the 10 Year US treasury note, 5 Year US treasury Note, UK Gilt, Euro Bund and the JGB Japan Futures on Go Markets Metatrader 5 platform

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Natural Gas getting ready to test important level

Natural Gas prices have had a volatile year to say the least. After finding multi decade highs on the back of geo-political volatility and record high inflation levels the price has seen an aggressive retracement. With the overall commodities market suffering a big drop as recessionary pressures have taken over and a resilient USD, Natural gas has ...

September 30, 2022Read More >Previous Article

When will the AUD find support?

The AUD has fallen to lows not since the beginning of the Covid 19 pandemic and does not look like stopping anytime soon. With global commodity prices...

September 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.